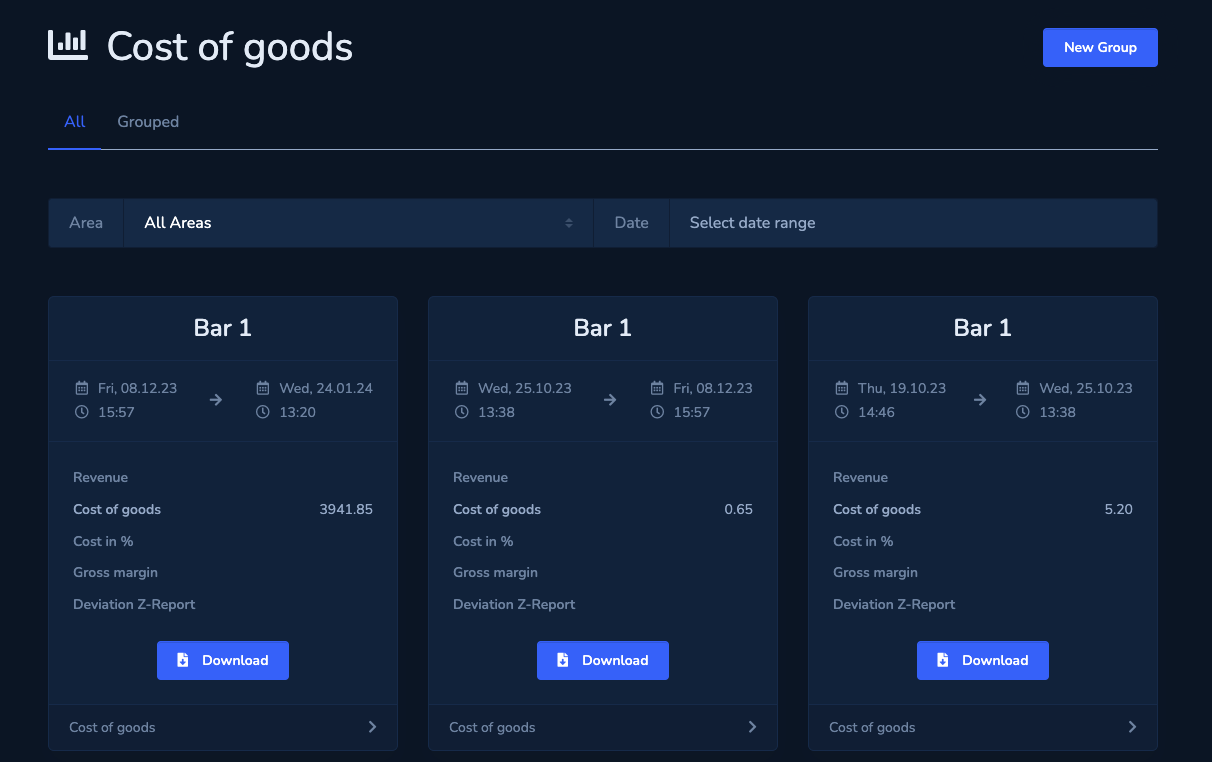

The cost of goods report is generated automatically as soon as you have taken stock in an area. This gives you your exact cost of goods for this period (from inventory to inventory). Select a report to access the details.

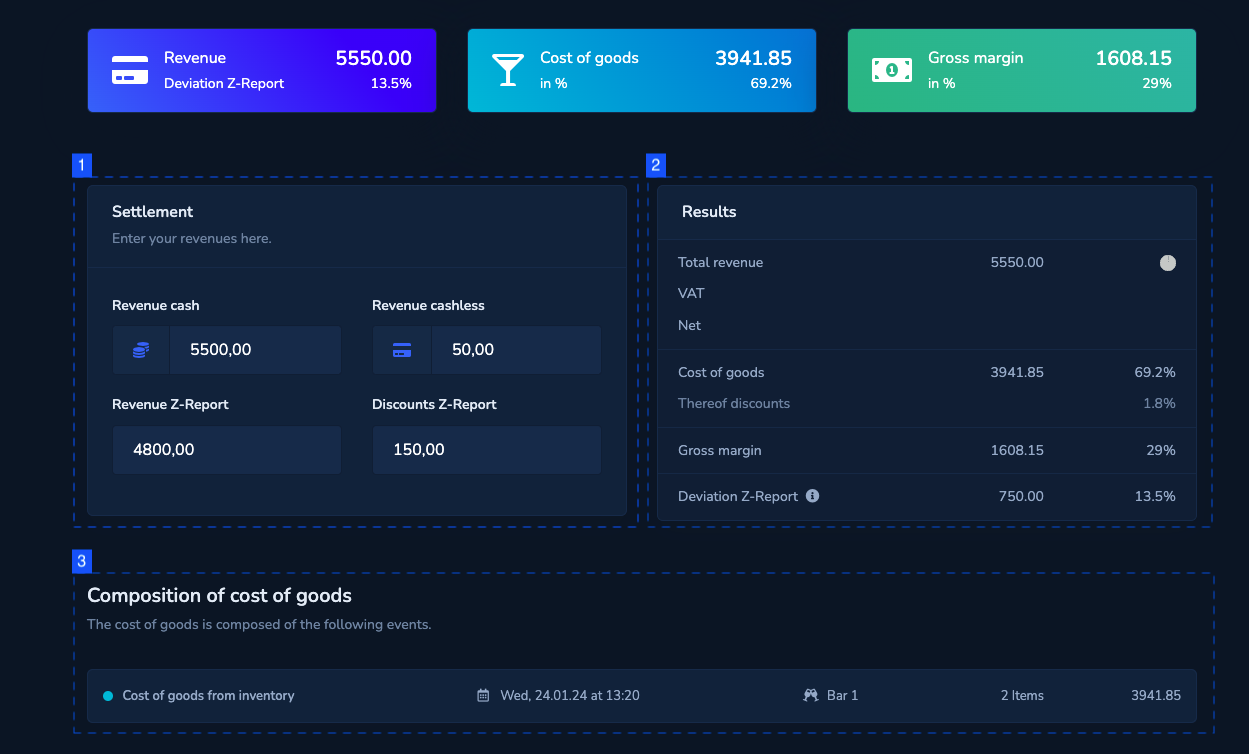

Overview

- Enter your revenues in “Settlement”:

- Enter the «Revenue cash» that this area has achieved. Click on the «Coin symbol» to open the calculator.

- Enter the «Revenue cashless» that this area has achieved through card payments. Press the «Card icon» to open the calculator.

- Enter the «Revenue Z-Report», which is shown on the statement of your cash register.

- Enter the «Discounts Z-Report», which is shown as discounts on the closing of your cash register.

- The data is then calculated accordingly under «Results»:

- «Total revenue» = sum of «Revenue cash» and «Revenue cashless».

- «VAT» = VAT from this area (see Settings).

- «Net» = «Total revenue» minus «VAT».

- «Cost of goods» = total of all items consumed.

- «Thereof discounts» = Percentage share of cost of goods based on «Discounts Z-Report».

- «Gross margin» = «Total revenue» or «Net» minus «Cost of goods».

- «Deviation Z-report» = Deviation between «Total revenue» and «Revenue Z-Report».

- Here you can see how the cost of goods is made up. Click on the corresponding inventory to access the details.

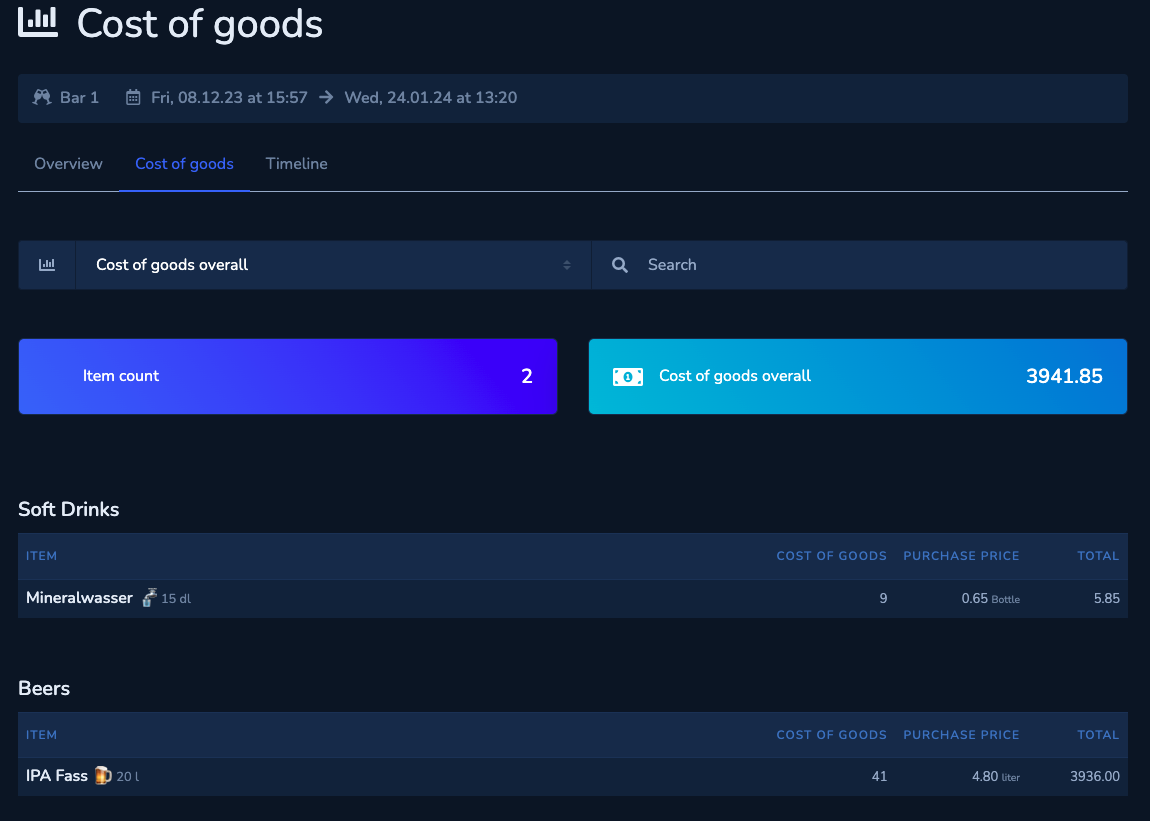

Cost of goods

Here you will find the total cost of goods for this period. You can also display individual events or search for items.

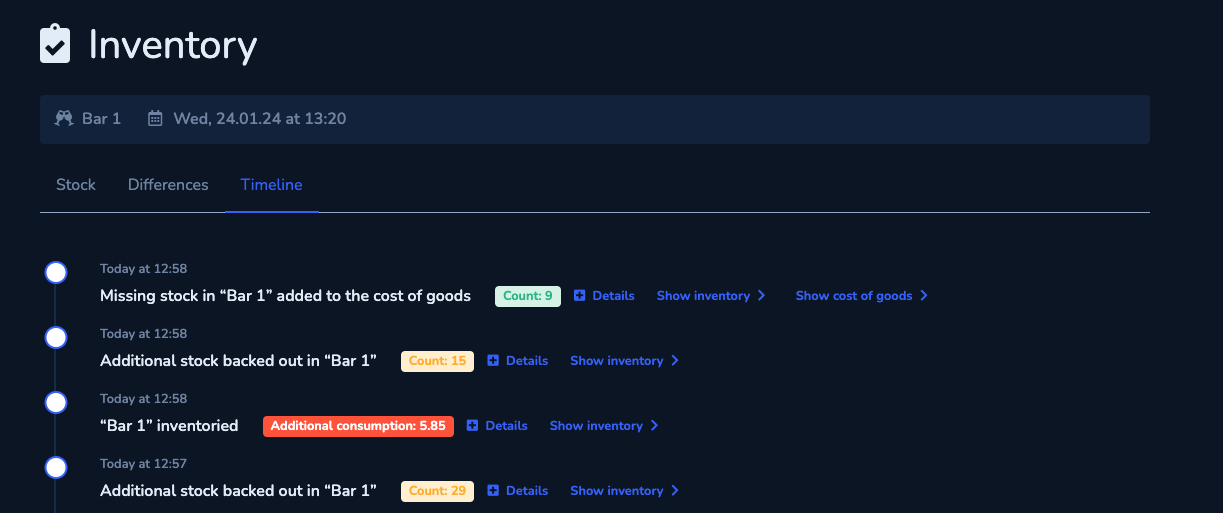

Timeline

Here you can see all the movements that have taken place in the area during this period.